how to avoid estate tax in california

Capital Gains Tax. Federal income tax rates are progressive and currently range from 10 to 37 for 2022Youll likely pay multiple rates that increase as your income increases.

California Estate Tax Everything You Need To Know Smartasset

We want to help you.

. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. IRS Code Section 1031 will not allow the avoidance of capital gains taxes in all cases. California Capital Gains Tax on Real Estate.

The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The total tax due is calculated by adding up the fair market values of all the decedents assets as of his date of death although the executor or administrator of the estate can elect to have everything valued on an alternate date. There is no federal inheritance tax but there is a federal estate tax.

When you need legal help with an estate probate or trust administration please call Ascent Law for your free consultation 801 676-5506. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Upon the death of a co-owner property titled as joint tenants with right of survivorship or community property with right of survivorship will pass to the surviving.

As discussed in our section on Using Deeds to Avoid Probate of California Real Estate joint ownership of real estate can avoid the need for probate at a deceased owners death. Kentucky Doesnt Collect an Estate Tax. Fourty-one states levy income taxes.

You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. For instance you can take advantage of the capital gains real estate tax exemption. Jana Shoulders and other financial advisors say tax planning is now essential to attracting and retaining high-net-worth clients March 7 Magazine Issue Year 2018.

One positive is that the beneficiary of the property receives a full step-up in basis value. Here are 14 of the loopholes the governments gain tax unintentionally incentivizes. Multiple ways are available to avoid the tax but none are beneficial to the economy.

We welcome your comments about this publication and suggestions for future editions. Nonresident Income Tax Return 1040-SR US. Because probate can be time consuming it may be advisable to avoid the probate process where possible.

The United States of America has separate federal state and local governments with taxes imposed at each of these levels. How To Avoid California Capital Gains Tax. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies.

The amount is withheld from the Seller right in the escrow transaction and sent to the Franchise Tax Board at closing. Gavin Newsom seeing red. Both federal and state governments have the power to impose an estate tax which is a tax on property transferred at death.

Once you turn age 59 12 you can withdraw any amount from your IRA. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year also known as a long term investment. But the measure on the upcoming November has Gov.

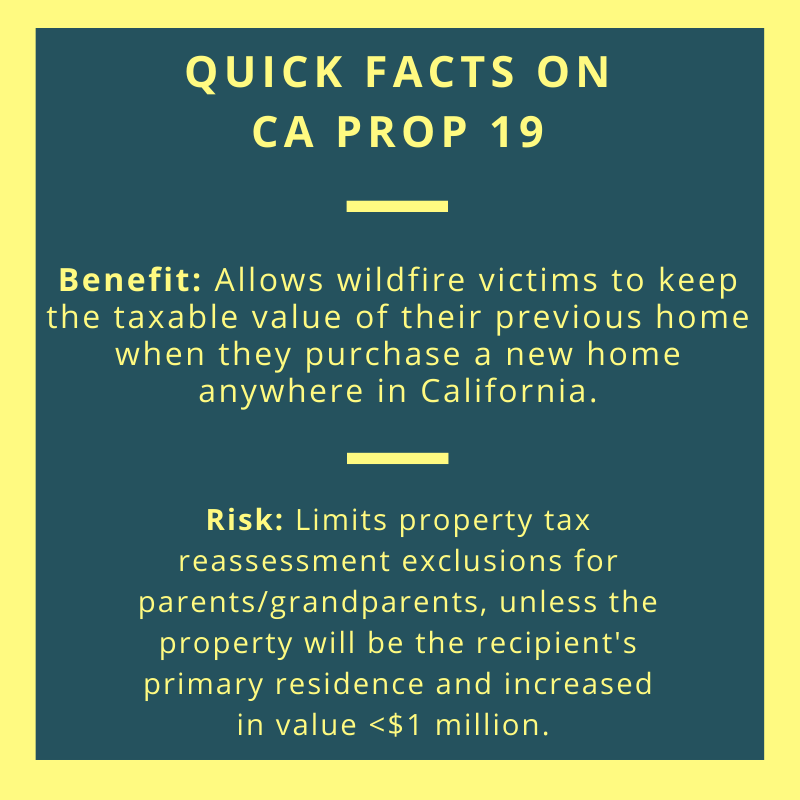

With certain limitations California Proposition 58 allows for the exclusion for reassessment of property taxes on transfers between parents and children. If you want to lower the tax bill on the sale of your home there are ways to reduce what you owe or avoid paying the full amount of capital gains taxes on your property. For example the exchange of US.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The estate tax which imposes a steep tax rate on sums over 117 million. NW IR-6526 Washington DC 20224.

The long-term capital gains tax rate is 0 15 or 20. 30 a measure that would tax the rich to fight climate change. This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died.

We want to help you. For estates that exceed this amount the top tax rate is. Rules and Regulations.

ProPublica found that none of these. Individual Income Tax Return 1040-NR US. California voters will be asked to consider Prop.

State of California Real Estate Withholding - The State regulations regarding withholdings on real property sales is a little different from the Federal withholding under the FIRPTA guidelines. California Estate Tax. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of.

For example if a child inherits his or her parents home when the current market value is 500000 that childs tax basis in the property. 982 Reduction of Tax Attributes Due to Discharge of Indebtedness and Section 1082 Basis Adjustment 1040 US. Dont name your estate as a beneficiary or youll lose the opportunity to bypass probatethe account would be distributed to your estate first then passed to your heirs according to your will.

And after death the common understanding goes theres a final no-escape clause. The federal estate tax is collected on the transfer of a persons assets to heirs and beneficiaries after death. Kentucky previously collected an estate tax but hasnt since January 1 st 2005.

Proposition 58 is codified by section 631 of the Revenue and. Real estate for real estate in another country. California does not levy an estate tax on any estates regardless of size.

Californias Proposition 58 which grants the ability to avoid property value reassessment on inherited real estate went in to effect on November 6 1986. Income Tax Return for Seniors 1099-S Proceeds From Real Estate Transactions 4797 Sales of Business Property 5405 Repayment of the First-Time Homebuyer. This means there will be no capital gain to worry about if the heir sells the asset because the heir receives the property at current market value.

State By State Guide To Taxes On Retirees Retirement Lifestyle Retirement Advice Retirement

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Property Tax Inheritance Exclusion

How To Inherit Your Parents House And Their Low Tax Bill Too

Taxes On Your Inheritance In California Albertson Davidson Llp

Is Inheritance Taxable In California California Trust Estate Probate Litigation

As A Trust Beneficiary Am I Required To Pay Taxes Annapolis And Towson Estate Planning Sims Campbell E In 2022 Estate Planning Getting Rid Of Rats Middle River

California Probate A General Timeline Probate Estate Planning Superior Court

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

How To Sell Inherited Property In California Without Hassle

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

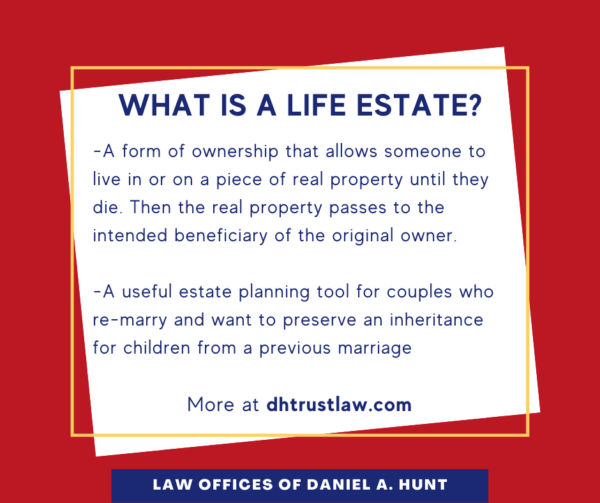

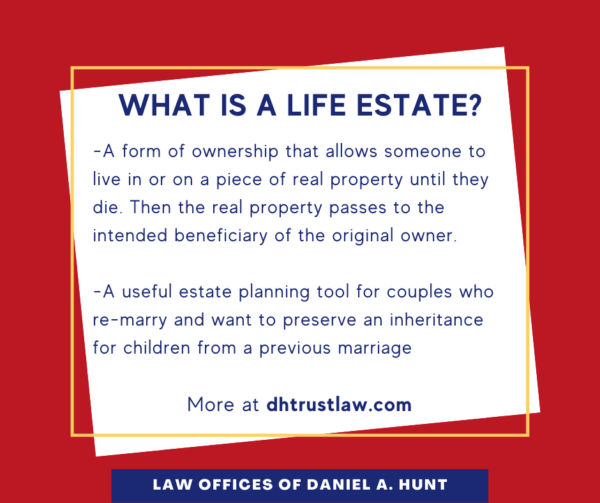

What Is A California Life Estate Law Offices Of Daniel Hunt

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement

Pdf Templates Power Of Attorney Form Power Of Attorney Free Medical

California Estate Tax Everything You Need To Know Smartasset